Top 100+ Facts To Know About The World

Top 100+ Facts To Know About The World : Youwannaknow.info![]()

You Wanna Know: Weird Facts Series

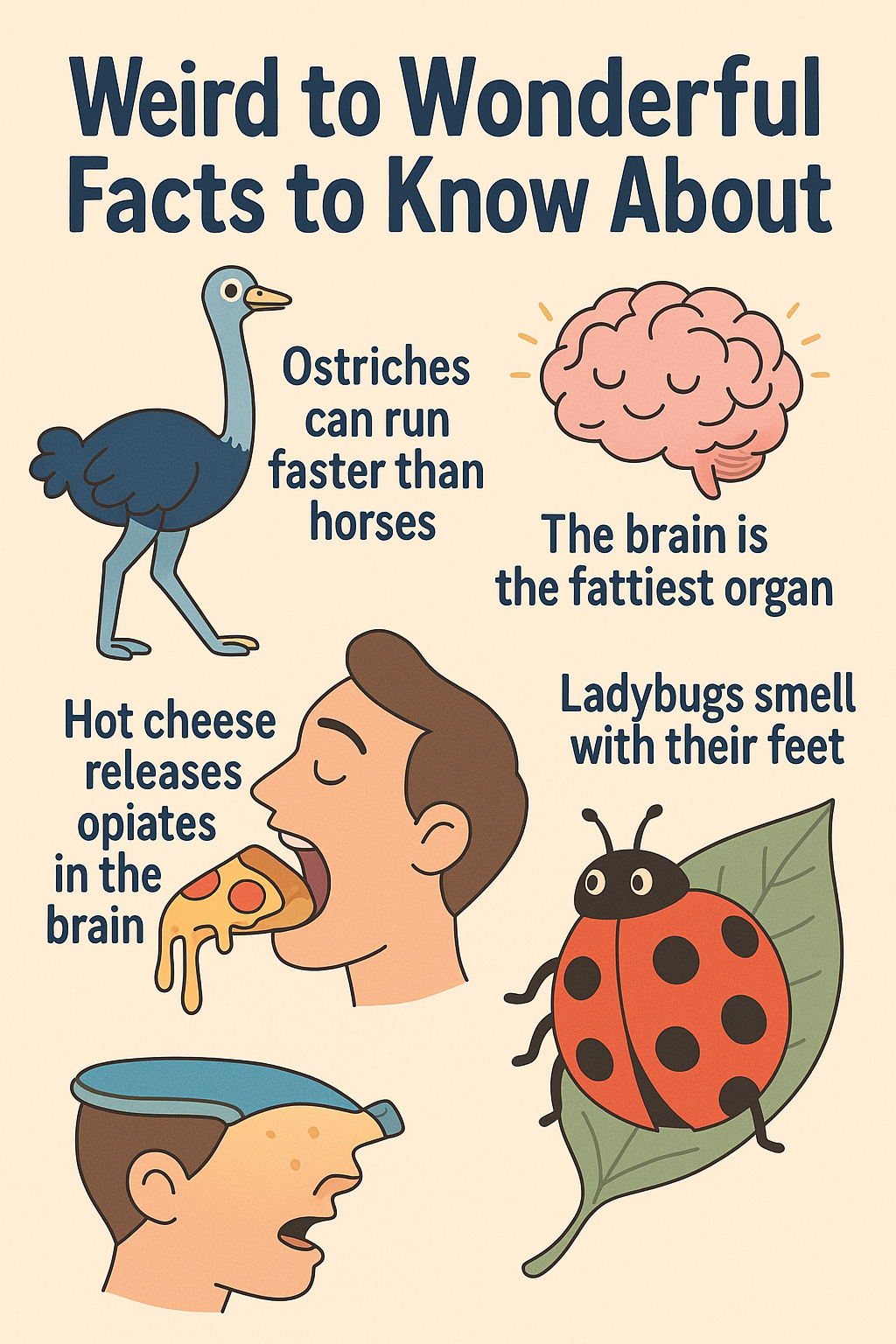

The world is full of mysteries—some so strange they sound like they belong in a sci-fi movie. That’s what the You Wanna Know: Weird Facts Series is all about. Here, we dig deep into the oddest, quirkiest, most mind-bending facts from around the globe. These aren’t your usual trivia tidbits—they’re the ones that make you pause and say, “Wait, what?!”

Did you know that wombat poop is cube-shaped? Or that bananas are technically berries but strawberries aren’t? From animals with bizarre abilities to strange human inventions that somehow exist, this series captures the wonderfully weird side of reality. There’s something uniquely entertaining about uncovering facts that defy logic—ones that make you rethink what you thought you knew.

We aim to celebrate the unexpected and the unconventional. Whether it’s the tale of the dancing plague of 1518 or the existence of pink dolphins in the Amazon, our goal is to keep your curiosity alive. Some facts are hilarious, others are borderline creepy, and a few are just plain ridiculous—but all of them are true.

This series is perfect for trivia lovers, fun fact fanatics, and anyone who enjoys sharing conversation starters that instantly grab attention. Next time you’re at a party, try dropping a weird fact from this series—you’ll either blow someone’s mind or make them laugh out loud.

So buckle up and dive into the strange corners of our planet. Embrace the bizarre, because weird is wonderful too. And in the end, you’ll not only know more—you’ll also have more fun sharing the unbelievable truths that most people never see coming.

You Wanna Know: Wonderful Facts Series

While the weird can be wild, the world also offers its fair share of jaw-dropping beauty, inspiration, and brilliance—that’s what the You Wanna Know: Wonderful Facts Series is here to explore. From nature’s most magical moments to humanity’s most heartwarming achievements, this series reminds us how truly incredible our world can be.

Imagine a flower that blooms only once every 12 years in the Himalayas, or a jellyfish that can potentially live forever. How about the fact that sea otters hold hands when they sleep so they don’t drift apart? These are the kinds of feel-good, awe-inspiring facts that make you smile and feel a little more connected to everything around you.

In this series, we highlight moments of wonder from all aspects of life—scientific breakthroughs, ancient wonders, natural marvels, and human kindness. Whether it’s the sheer scale of the Great Wall of China or the way bees can recognize human faces, there’s no shortage of wow-worthy moments to uncover.

We believe that knowledge doesn’t just feed the brain—it can also lift the spirit. Every fact in this collection is a reminder that the world, despite its chaos, is still full of magic and meaning. The more you know, the more you realize how much good there is to celebrate.

So if you’re in need of some inspiration or just want a reason to believe in the beauty of the world, the Wonderful Facts Series is your new favorite read. Let yourself be amazed—because sometimes, truth is even more wonderful than fiction.

Explore, Share, and Stay Curious with “You Wanna Know!”

Welcome to You Wanna Know!, your ultimate hub for all things fascinating, mind-blowing, and downright cool. Whether you’re into the weird, the wonderful, or everything in between, this site is made for the curious soul in all of us. We believe that knowledge should be fun, surprising, and worth sharing—and that’s exactly what you’ll find here.

If you’ve ever asked, “Why does this happen?” or “Is that even real?” — you’re in the right place. Every fact, article, and series on this site is designed to spark your curiosity and give you stories worth telling. So dive in, explore the bizarre and beautiful sides of life, and don’t forget to share your favorite discoveries with friends, family, and fellow fact-lovers. Because the more we share, the more we all know—and hey, who doesn’t love being the smartest one in the room?

Let the adventure begin. You wanna know? We’ve got it covered. 🌍✨

This is Our website Link:

Youwannaknow.info

we have more website to visit :

momdadsphere.com